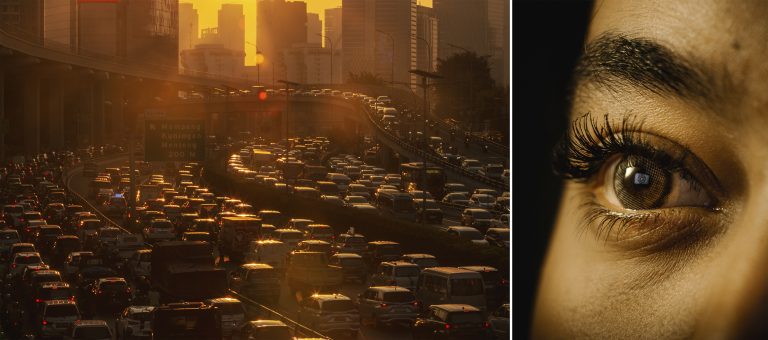

Indonesia’s four largest banks made public claims that they were trying to practice “green and sustainable” banking after the 2015 Paris Agreement. However, they continued to provide money to the coal industry, despite reports on how the industry was damaging the environment, displacing people, and harming children.

Between 2017 and 2021, Indonesia’s annual coal production rose from 461.4 million metric tons to 606.8 million tons according to data from the Energy and Mineral Resources Ministry. The same period saw an increase in yearly coal exports from 286.9 million tons to 315.9 million tons.

Financial institutions—including banks—contributed to this increase, serving as direct lenders, underwriters, or buyers of bonds that coal producers issued.

The Global Coal Exit List, a report compiled by Urgewald and other international NGOs, found that at least 16 national and multinational financial institutions in Indonesia were financially linked to 70 national coal producers between January 2019 and November 2021.

Some of the largest borrowers were PT Bumi Resources, PT Adaro Energy Indonesia, PT Sinar Mas, PT Indika Energy, PT Berau Coal Energy, PT Bayan Resources, and a holding company for state-owned mining firm Mining Industry Indonesia or MIND ID.

Project Multatuli and a research team at 350.org, part of a coalition of civil society organizations (CSOs) called #BersihkanBankmu or “clean your banks”, traced the publicly available financial reports of coal producers and banks. The research revealed the quantity of funding banks had channeled into the industry, despite their commitment to going “green”.

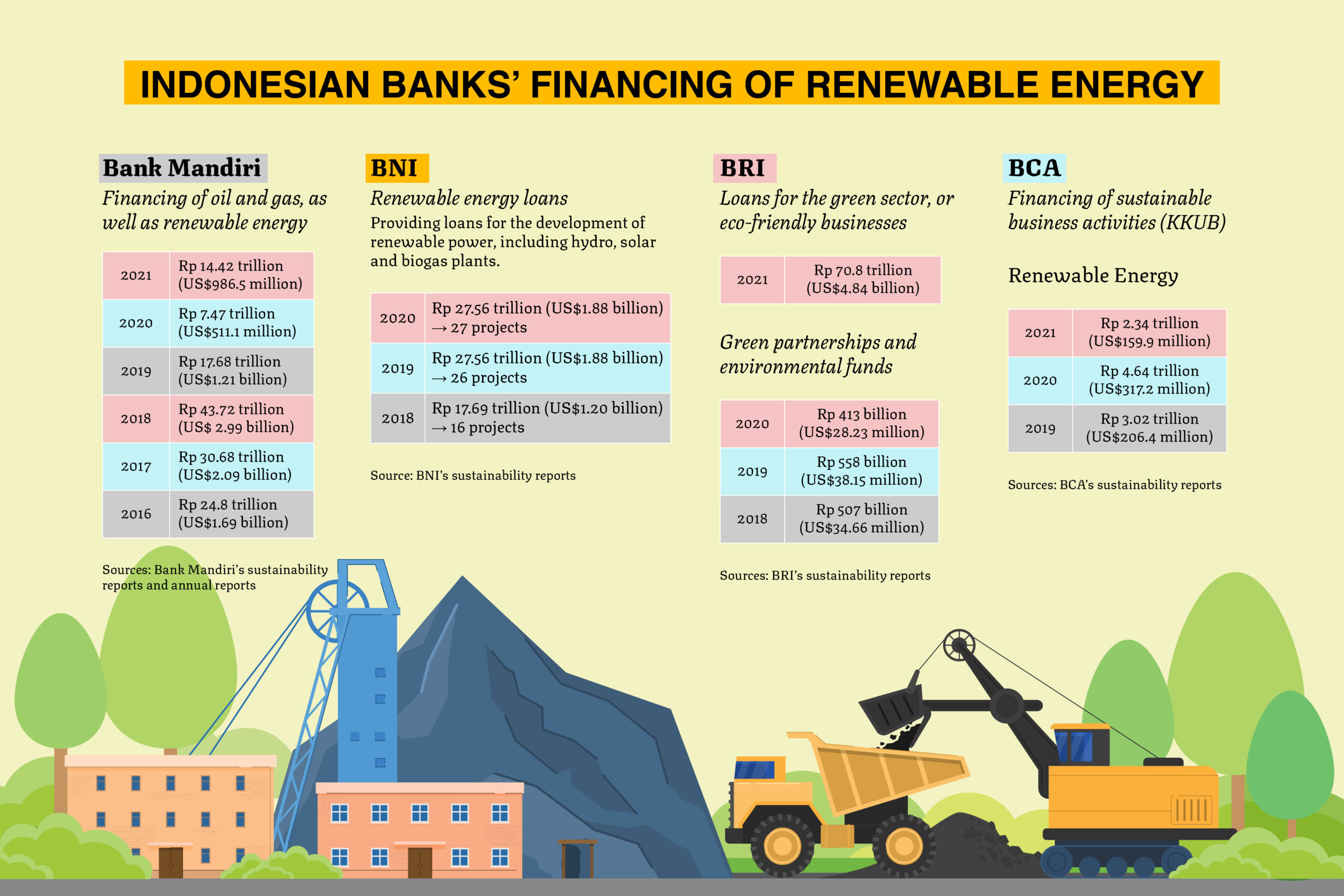

Our report focuses on how much money Bank Mandiri, BNI, BRI, and BCA provided to the coal industry between 2015 and 2021.

Winner: Bank Mandiri

State-owned Bank Mandiri played pivotal and varied roles in helping coal companies get their hands on capital by serving as a bookrunner, lender, underwriter, bond buyer, arranger, and facilities agent.

The 2020 Global Coal Exit List, which covered the years 2018 to 2020, found that Mandiri channeled a total of US$4.62 billion to coal companies – the most of any Indonesian financial institution. In the 2016 to 2020 period, Mandiri was the second-largest financier of the coal industry at $5.8 billion, according to Fair Finance Asia.

Project Multatuli and 350.org found that between 2015 and 2021 Mandiri lent most of its coal funds to PT Dian Swastatika Sentosa (DSS), a subsidiary of Sinar Mas Group that holds coal concessions throughout Indonesia and Australia.

Mandiri granted financing in the form of investment credit, transaction loans, deficit limits, and syndicated loan facilities on the accumulated loans of $1.16 billion during the period, which included the $74 million lent to PT DSSE Energi Mas Utama, a DSS subsidiary, in 2019.

That year, DSSE signed a seven-year syndicated loan facility agreement with PT Sarana Multi Infrastruktur (Persero), Mandiri, BCA, Bank Permata, and Shinhan Bank worth $370 million.

Mandiri’s second-largest financing disbursal, of around $780.5 million, was given to PT Indika Energy, one of the largest holding companies in the country’s coal industry, owned by the Sudwikatmono family.

Mandiri was the initial buyer of dollar-denominated bonds that Indika Energy issued in late 2020, worth $675 million. Indika Energy also appointed the Singapore branch of Standard Chartered Bank Ltd., Mandiri Securities Pte Ltd., and the Singapore branch of Deutsche Bank AG as the joint bookrunners and original purchasers of the bonds.

In addition, Mandiri financed a coal company founded by Coordinating Maritime Affairs and Investment Minister Luhut Binsar Pandjaitan called PT Toba Bara Sejahtra and later renamed PT TBS Energi Utama. Financial reports from 2017 to 2020 show that at least $456.27 million in loans and credit facilities were given to TBS Energi Utama.

Not only did the bank support these three major companies, it also provided $256.5 million to Indika Energy subsidiary PT Petrosea, which focused on mining contract services. It also lent PT Bukit Asam $197.32 million from 2016 to 2018, PT Golden Energy Mines—affiliated with Sinar Mas Group—$182 million from 2017 to 2019 and Adaro Energy $91.48 million from 2015 to 2018.

Project Multatuli contacted Bank Mandiri’s corporate secretary to inquire about the flow of funds, but the request went unanswered. Nonetheless, in a statement quoted by CNBC Indonesia in early April, Mandiri noted a positive outlook and growing demand in the coal and oil and gas sectors during the economic recovery from the COVID-19 pandemic.

Bank Mandiri director of risk management Ahmad Siddik Badruddin said the company would continue financing coal companies while taking environmental, social, and governance (ESG) concerns into account as conditions for lending.

“We won’t yet cut our credit portfolio for coal or other oil and gas sectors, but we have set up certain requirements for borrowers in the industry. Therefore, despite the growth in our credit portfolio, we’re also fully aligning our partners with the applicable ESG strategy in Indonesia,” said Ahmad Siddik in an interview with CNBC Indonesia on April 2.

Runner Up: ‘Campus Bank’ BNI

BNI, dubbed “Bank Kampus”, a bank for university students because of its many partnerships with state and private universities, has also funded a number of coal companies operating in Indonesia. The 2020 Global Coal Exit List lists BNI as the second-largest supporter of the coal industry from 2018 to 2020 for channeling $2.09 billion into the industry as both a lender and underwriter.

BNI’s financial report suggests that its objectives in the sector are quite similar to Mandiri’s, as demonstrated by its funding of Indika Energy.

On June 1, 2017, Indika Energy received a credit facility from BNI’s Singapore branch with a joint credit limit of $5 million.

In April 2021, BNI acted as the term loan facility agent for Adaro Energy, which signed a $400 million syndicated loan agreement with BNI, BRI, Bank Danamon, British multinational investment bank HSBC, and Bank of China’s Jakarta branch. BNI contributed $49 million to the arrangement.

In December 2020, BNI provided a three-year loan to Dian Swastatika Sentosa (DSS), a subsidiary of Sinar Mas, at the maximum amount of $15 million.

BRI, as Big as it Gets

BRI was the largest lender to the Indonesian coal industry from 2016 to 2020 in terms of accumulated loans, totaling $6.9 billion, according to Fair Finance Asia.

Data from the 2020 Global Coal Exit List for the 2018 to 2020 period, however, shows that BRI, the country’s largest bank by total assets, fell to 3rd as financier of the nation’s coal industry, contributing $1.76 billion.

BRI loaned $116.97 million to mining contractor PT Darma Henwa, owned by Bakrie Group, on April 22, 2019. Darma Henwa was granted credit facilities to obtain mining equipment, and BRI took over Darma Henwa’s debt to PT Bank Victoria International.

The figure was included in the investment credit facility of Rp 8.75 billion allotted to Darma Henwa to pay off Bank Victoria. BRI also provided Rp 18.8 billion in investment credit to Bukit Asam, distributed in two parts, one in July 2018 and the other in January 2019. Moreover, BRI approved a credit proposal from TBS Energi Utama of Rp 15.5 billion in 2016, with $2.27 million owed in interest. The loan came due on Dec. 31, 2019.

BRI corporate secretary Aestika Oryza Gunarto said the company had gradually stopped financing the coal industry.

“Going forward, BRI will continue focusing on MSMEs while shifting away from channeling credit to the mining sector, including coal,” said Aestika when asked to comment April 7.

As of the end of December 2021, Aestika noted, BRI had 0.6 percent of its total financing in the mining and extraction sectors.

BCA, Largest Private Lender to Coal

The 2020 Global Coal Exit List classifies BCA as the largest private lender to, and underwriter of, coal companies, providing $316 million between 2018 and 2020, $88 million of which was distributed to PT United Tractors, a subsidiary of PT Astra International that operates in the coal and construction machinery sectors.

BCA CEO Jahja Setiaatmadja told his borrowers in the coal sector to repay their debts following the recent spike in commodity prices coinciding with the economic recovery from the pandemic.

“We see that the prices of CPO, minerals, and copper have made their way up. Just imagine. It’s a good opportunity [for businesses dealing in those commodities] to fully repay their existing loans,” said Jahja during a Banking Outlook 2022 event in early March.

In March 2017, Jahja noted an increase in the bank’s 2016 nonperforming loan (NPL) ratio in 2016 by 0.7 percent from the previous year to 1.3 percent. He said that borrowers in the coal sector had contributed to the surge.

Researchers from 350.org found that between 2018 and 2020, BCA had granted loans to at least two coal companies. In January 2019, the bank agreed to transfer the Rp 171.71 billion credit facility from Mandiri that Dian Swastatika Sentosa (DSS) had secured to invest in mining.

In the same year, BCA joined Mandiri, Permata, PT Sarana Multi Infrastruktur, and Shinhan Bank in granting a total of $370 million in seven-year loans to DSSE. BCA provided $74 million of the total sum.

BCA also provided a credit facility of Rp 10 billion to PT Alfa Energy Investama.

The Global Coal Exit List 2020 listed BCA as a financier of state electricity company PLN, loaning $228 million to the company. Mandiri, BNI, and BRI, however, lent more at $2.98 billion, $1.8 billion, and $1.49 billion respectively.

The funds channeled to PLN were not necessarily aimed at financing coal-fired power plants (PLTU). However, PLN’s energy mix remains dominated by fossil fuels. As of the end of December 2020, PLN’s power supply mix was 32.02 percent coal-fired power plant energy, 17.73 percent steam-and-gas-powered power plant (PLTGU) energy, 8.76 percent diesel power plant (PLTD) energy, and 5.66 percent hydroelectric power plant (PLTA) energy. The remaining 35.83 percent of the installed capacity came from rented or independent power producers.

Green Label

In 2017, the Financial Services Authority (OJK) introduced a requirement that financial services institutions submit an annual Sustainable Finance Action Plan, which lays out a timeline for implementing the firm’s green transition.

Since 2019, financial services institutions have had to release separate sustainability reports and annual reports.

Aestika of BRI said the bank was committed to complying with all rules on environmental conservation in its business operations.

“In every instance of financing or credit for a project that [has the potential to] harm the environment, for example, BRI will review the risk that it may bring and will only participate in financing the project if the borrower follows the checklist on certain issues, like environmental impact assessments (AMDAL) and relevant environmental certification,” said Aestika.

Mandiri has claimed since 2019 in its sustainability reports that it strives to be the pioneer of “green banking” and that it has enacted policies to make its products and services more environmentally friendly. The bank has declared its support for eco-friendly financing and investment programs, albeit in a limited capacity.

In its 2019 sustainability report, Mandiri wrote, “It is hard to cast aside certain challenges in the implementation of a green product portfolio, as clear requirements as to how standardized environmental and social audits of borrowers are carried out remain absent.”

Like Mandiri, BNI and BCA also claim to have avoided dealing with projects or businesses that could seriously harm the environment.

“BNI, in disbursing loans, has been applying Green Banking, which prioritizes environmental sustainability,” BNI’s sustainability report in 2018 reads.

Regulatory issues

Dwi Rahayu Ningrum, a researcher with Perkumpulan Prakarsa, a Jakarta-based think tank, said domestic banks had filled the gap that global banking had left in coal industry financing. As of 2019, according to a report by the Institute for Energy Economics and Financial Analysis, more than 100 globally significant financial institutions had divested from thermal coal projects, including 40 percent of the top 40 global banks and 20 globally significant insurers.

The absence of strict regulations governing the financing of fossil fuels has allowed domestic banks to continue lending to the coal industry.

In the green finance taxonomy that the Financial Services Authority (OJK) issued earlier this year, coal projects are classified as yellow—meaning the agency believes they pose no significant harm—and can still receive loans from national banks.

The OJK’s scheme allows coal projects to be financed as long as they meet the required waste quality standards issued by the Environment and Forestry Ministry.

The government may be lax about the banks’ promised sustainability commitments, said Binbin Mariana, finance and energy campaigner at Market Forces, but banks had to consider their public reputation as well. Banks that did not consider climate change as a factor in offering loans, underwriting services, or syndicated financing, she added, would risk ruining their reputation and performance.

Those banks, said Binbin, did not see how the businesses that they supported could ultimately lose because of climate factors.

Extreme weather, for example, interrupts mining operations, but the coal industry has been the single biggest industrial contributor to greenhouse gas emissions, which accelerate climate change and increase instances of severe weather.

The International Energy Agency (IEA), an intergovernmental organization, has predicted that the demand for coal in the future will decline. Taking into account that 20 percent of Indonesia’s coal is used domestically and the remainder is exported, future financial losses are possible.

“Losses in a company will affect its ability to repay its loans and debts,” said Binbin. “It is something that banks should be concerned about.”

She also urged bank customers to keep track of how their money was used, especially in terms of environmental sustainability.

“We deposit our money there. If we want our kids and grandchildren to live good lives in the years to come, we should also ask banks to stop financing coal companies.”

This report was supported by Change.org and the #BersihkanBankmu coalition.

Researchers: Research team at 350.org, Ronna Nirmala

Editor: Ronna Nirmala, Evi Mariani