A closer look into the ‘downstreaming’ of Indonesia’s booming nickel industry, its connection to Chinese capital and members of the Indonesian oligarchy.

When Indonesian President Joko “Jokowi” Widodo officially took office in October 2014, he inherited President Susilo Bambang Yudhoyono’s policy of banning the export of raw minerals, including nickel ore and bauxite. That policy, known as “hilirisasi” or “downstreaming”, has a clear goal: turning Indonesia into a place where raw minerals are not just mined, but also refined – and so boosting the domestic processing industry.

Throughout his presidency, Jokowi has made downstreaming a key policy, and one that he believes will help Indonesia “leapfrog” into developed country status. While it remains to be seen if his dream will turn into reality, the policy is set to benefit not only his oligarchic backers, but also the country’s largest trade partner: China.

A Project Multatuli investigation has shown that Jokowi’s strategy to downstream the nickel industry — considered by his administration to be a successful policy — has been a boon for Beijing. Our investigation shows how Chinese investment dominates the downstream nickel industry in Indonesia, even though local entrepreneurs are slowly emerging from the fringes, through corporate groups such as Adaro, Aserra, Bintang Delapan, Harita, Jhonlin, Kalla, Merdeka Copper, Rimau, and Saratoga.

We examined the history, ownership structure and business networks of four nickel mining companies with the largest concessions in Indonesia. The information and data used come from a variety of sources, including the Ministry of Law and Human Rights’ Limited Liability Company Database, the Ministry of Energy and Mineral Resources’ Minerba One Data Indonesia and Minerba One Map Indonesia portals, annual and financial reports of various mining companies, research by non-governmental organizations, court records, and news articles.

Indonesia’s Nickel Boom

Raw nickel can be processed into various commodities, including coins, wire, stainless steel and electric vehicle batteries. Given the global shift towards electric vehicles and the pressure to reduce carbon emissions, the Jokowi administration has opened a wide door for investment to develop domestic mining and processing of Indonesia’s abundant nickel supplies.

According to the United States Geological Survey (USGS), Indonesia’s proven reserves of nickel stand at 21 million tonnes, the largest in the world alongside Australia. Together, the two countries hold 21 percent of the world’s nickel reserves.

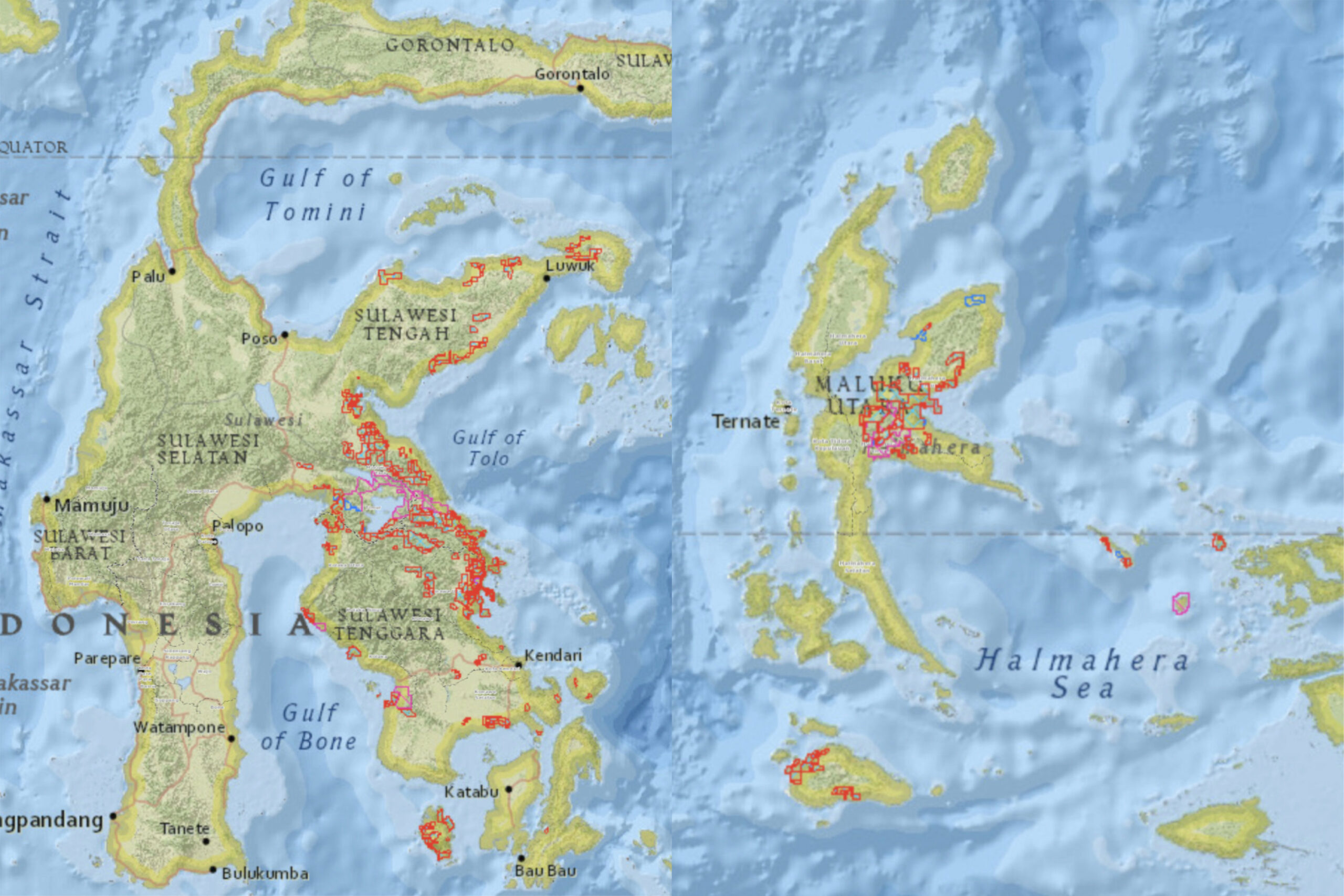

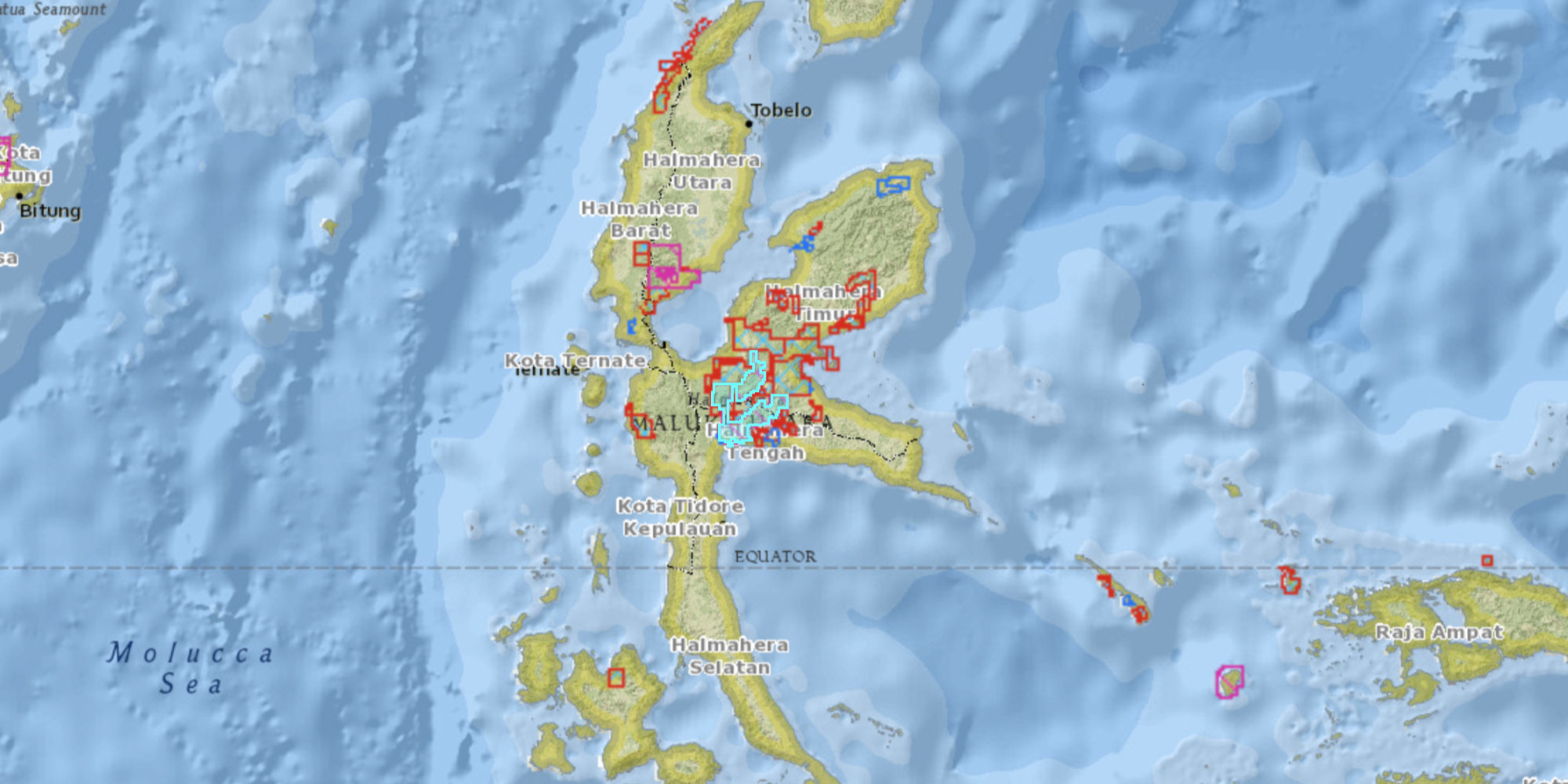

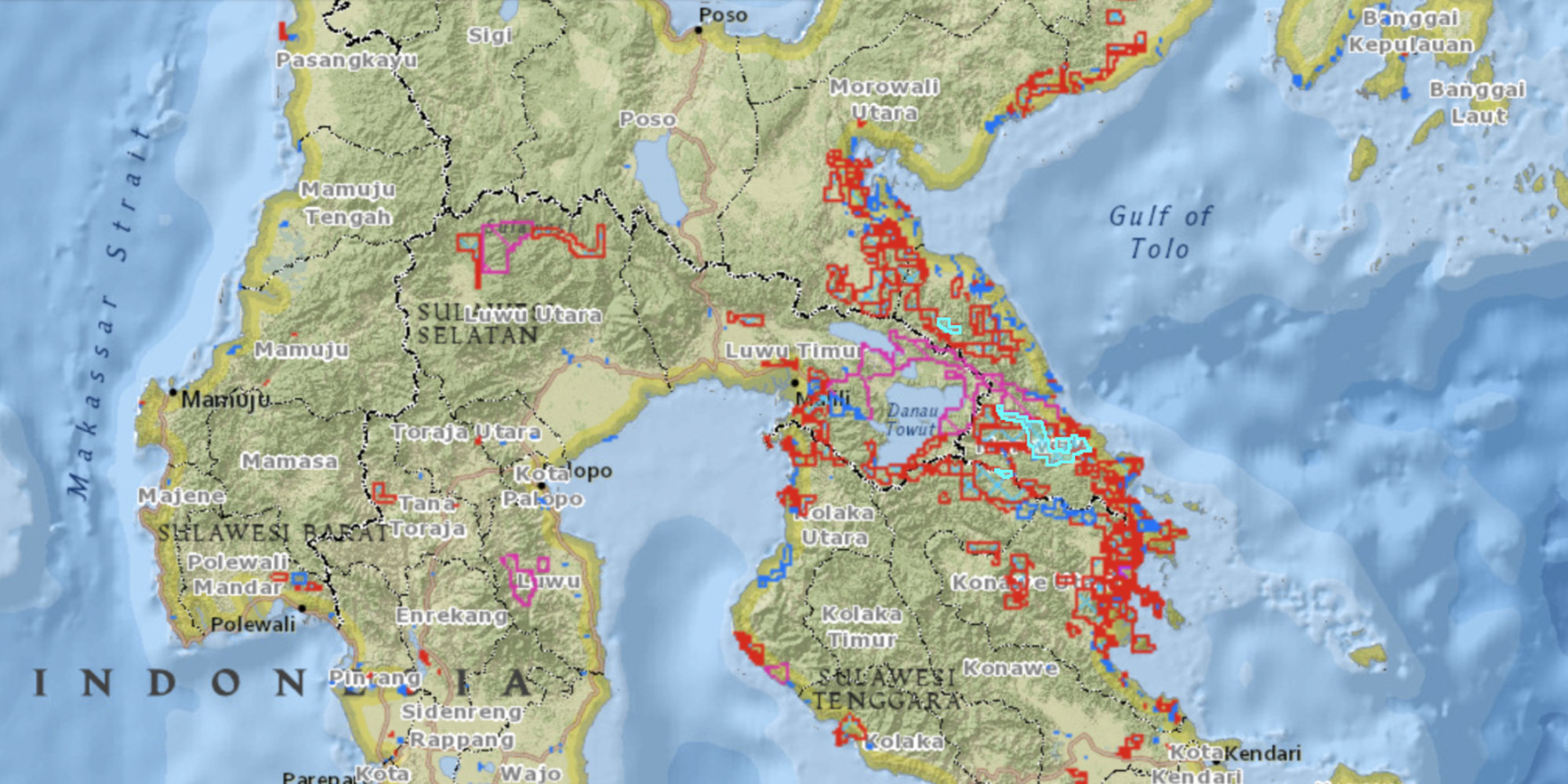

Indonesia’s nickel supply is concentrated in two places: the island of Sulawesi, whose proven reserves account for 54.7 percent of Indonesia’s total, and the Maluku Islands, with 44.6 percent. As a result, foreign and local investors have flocked to the two regions to either mine or build nickel processing plants.

As of 2023, there were 373 nickel mining concessions with ‘clean and clear’ or CnC status issued by the government, either in the form of mining business licenses (Izin Usaha Pertambangan) or contracts of work (Kontrak Karya). These cover a total area of 960,117 hectares. Out of all of the concessions, 309 of these, covering an area of 691,929.6 hectares, are located in South, Southeast and Central Sulawesi. Then, there are 59 concessions in North Maluku and one in Maluku with a total area of 231,486.4 ha

Out of the hundreds of concessions, Project Multatuli has identified four companies, or groups of companies, that control CnC concessions totalling 271,650.5 ha or more than 28 percent of Indonesia’s nickel mining land. These are PT Vale Indonesia, PT Aneka Tambang, PT Weda Bay Nickel and the Bintangdelapan Group.

In addition to controlling vast amounts of land, they represent different interests and chapters in the long history of Indonesian nickel mining.

PT Aneka Tambang was originally the General Governing Agency of State Mining Companies (BPU Pertambun), which was tasked with managing all state mining companies and projects outside oil, gas, coal and tin sectors during the era of Indonesia’s first president, Sukarno.

PT Vale Indonesia was the second foreign company to enter Indonesia after PT Freeport Indonesia. It signed a contract with the Indonesian government in 1968, when Sukarno’s successor, the authoritarian president Soeharto, was aggressively attracting foreign investment in the domestic mining sector.

PT Weda Bay Nickel is a company that signed a contract with the government during the chaotic time just before the collapse of the Soeharto regime. It has weathered various changes and uncertainties in government policy, whether related to mining in forest areas or a ban on the export of raw minerals.

The Bintangdelapan Group is a local private company that has paved the way for a large influx of investment funds, mainly from China, into Indonesia after teaming up with the giant stainless steel producer Tsingshan Holding Group since October 2013. This cooperation was part of China’s Belt and Road Initiative (BRI), launched just a month earlier.

We know this article won’t be a breeze to get through. It’s a long, complex piece – and relevant mainly to those with an existing interest in Indonesia’s mining industry, political oligarchy, and China’s overseas investments. But a lot of work went into it.

The writing and editing process of the original Indonesian-language story took months and required commissioning an illustrator and a photo editor. The subsequent translation to English involved five people (with a small hand from AI). Some of this team volunteered and others were paid – but their remuneration wasn’t as high as we’d like.

We’re an independent media outlet and rely on support from readers like you. So we’d be immensely grateful for any amount you can donate to Project Multatuli. And don’t forget to share our articles with friends and colleagues interested in Indonesia.

Thank you!

Who Will Benefit?

China has aggressively invested in Indonesia’s nickel industry.

The stated aim of China’s BRI is to build an “economic belt” or land trade route linking China to parts of Southeast Asia, South Asia, Central Asia and Europe, and a “maritime road” or sea trade route from China’s coastal regions to Southeast Asia, South Asia, the South Pacific, the Middle East, East Africa and Europe.

Through the BRI, China is extending its influence by pouring money into building infrastructure in various countries, including the Jakarta-Bandung high-speed train, dams, power plants and nickel processing facilities in Indonesia.

Some observers see the move as a way for China to secure political support from vulnerable economies in the Asia-Pacific region through project debt.

The value of Chinese and Hong Kong investment in Indonesia has continued to soar. From just US$1.46 billion in 2014, it peaked at US$13.7 billion in 2022, before falling to US$10.8 billion a year later. China and Hong Kong initially accounted for just 5.1 per cent of total foreign investment. By the end of the decade, their share had risen to 28.6 percent.

It is important to note that Hong Kong is a gateway for Chinese companies to invest overseas. Many Chinese subsidiaries in Hong Kong, for example, are used to facilitate the management of nickel smelting projects in Indonesia.

Early smelters built in Indonesia were rotary kiln-electric furnace (RKEF) smelters, which use heat to convert nickel ore into low-grade ferronickel or nickel pig iron (NPI), which can be used as an ingredient in stainless steel production.

More recently, high-pressure acid leach (HPAL) plants have emerged, using sulphuric acid to separate nickel and cobalt compounds from laterite nickel ores. The result is a mixed hydroxide precipitate that can be further processed to make batteries for electric vehicles.

As of 2023, there are 116 nickel smelter projects in Indonesia, including those in operation, under construction and in planning. Of these, 97 are RKEF smelters and a further 19 are HPAL technology smelters. This compares to only 31 projects in 2014.

As a result, the demand for nickel ore to be processed by the 47 smelters in operation will reach 233.5 million tonnes in 2023 alone, even though Indonesia’s total nickel production at that time was only 193 million tonnes. As a result, the government is planning a moratorium on the construction of new nickel smelters, especially those using RKEF technology, in order to maintain supply.

However, the problem with the proliferation of nickel mines and smelters is not just supply-related. Nickel mining operations in Indonesia are estimated to have caused 78,948 ha of deforestation since 2014.

The steam-electric power station operations in the Morowali Industrial Estate in Central Sulawesi and the Weda Bay Industrial Estate in North Maluku, for example, have polluted the air and caused an increase in acute respiratory infections. Not to mention the problems of land acquisition, which have triggered social conflicts and even led to smelters being built on indigenous peoples’ land.

Moreover, investment in the manufacturing sector is capital-intensive, not labor-intensive. Typically, many workers are only needed in the early stages of infrastructure construction. After that, machines do the work. Throughout 2017-2022, the poverty rate in Southeast Sulawesi, for example, remained higher than the national rate.

The question then arises: Who exactly benefits from downstreaming?

Below is everything you need to know about the four local companies holding the largest nickel mining concessions in the country and their connections to Chinese capital and members of the Indonesian oligarchy.

***

1. PT Vale Indonesia

CnC Nickel Concessions: 118,017 ha

Areas of operation: South Sulawesi, Southeast Sulawesi and Central Sulawesi

Nickel resources: 300 million tonnes

Nickel Ore Production: 11.55 million tonnes (2022)

As of 2023, Vale Canada and Vale Japan controlled 43.79 percent and 0.54 percent of PT Vale Indonesia, while Sumitomo Metal Mining holds 15.03 percent and state-owned mining holding company PT Mineral Industri Indonesia (Mind ID) 20 percent. The rest is owned by members of the public through the Indonesia Stock Exchange.

However, this composition is about to change. In November 2023, Vale Canada, Sumitomo Metal Mining and Mind ID signed a Memorandum of Understanding (HoA) to increase Mind ID’s stake and extend PT Vale Indonesia’s operating license for 20 years from the end of the contract in December 2025.

If all goes according to plan, Mind ID will control 34 percent of PT Vale Indonesia, while Vale Canada and Sumitomo Metal Mining’s stakes will shrink to 33.9 percent and 11.5 percent respectively. The rest will be held by the public.

Despite repeated reductions, PT Vale Indonesia’s concession remains the largest compared to other nickel miners in Indonesia. This is the breakdown: 70,566 ha in Sorowako (South Sulawesi); 22,699 ha in Bahodopi (Central Sulawesi); 20,286 ha in Pomalaa and 4,466 ha in Suasua (Southeast Sulawesi).

However, PT Vale Indonesia only controls nickel resources of 300 million tonnes, less than a quarter of state-owned PT Aneka Tambang’s nickel resources of 1.31 billion tonnes in its 81,424.5 ha concession.

By 2022, PT Vale Indonesia will have mined 11.55 million tonnes of nickel ore, which it will then process into 60,090 tonnes of nickel matte – a semi-finished product that can be used to make alloy steel, raw materials for electric vehicle batteries and other products.

Through long-term contracts, PT Vale Indonesia sells 80 percent of its nickel matte production annually to Vale Canada and the remaining 20 percent to Sumitomo Metal Mining.

All of the company’s mining and processing activities are carried out on 7,000 hectares of land in Sorowako. This means that after more than half a century of operations in Sulawesi, the company has only used about 6 percent of its current concession.

Sorowako Past and Present (1990 vs 2020)

In the face of criticism over the underutilization of its concession area and ahead of the expiry of its work contract in 2022, PT Vale Indonesia is working with several partners to expand its operations.

First, PT Vale Indonesia is working with two Chinese companies, Taiyuan Iron & Steel and Shandong Xinhai Technology, to start operations at the Bahodopi block mine and build a new pyrometallurgical plant using RKEF technology in Sambalagi village, both in Morowali, Central Sulawesi.

The smelter is expected to be operational in 2025 with an annual production capacity of at least 73,000 tonnes of nickel in ferronickel. The total value of the project is US$2.6 billion (Rp40.2 trillion).

The Morowali project will be managed by PT Bahodopi Nickel Smelting Indonesia (BNSI). Taiyuan Iron & Steel, a subsidiary of China’s state-owned Baowu Steel Group, and Shandong Xinhai Technology plan to set up a joint venture in Singapore that will control 51 percent of PT BNSI. PT Vale Indonesia will hold the remaining 49 percent.

Also in 2022, PT Vale Indonesia signed a cooperation agreement with electric vehicle battery raw material producer Zhejiang Huayou Cobalt, a subsidiary of China’s Huayou Holding Group, and US carmaker Ford Motor to develop a nickel mine and smelter in Pomalaa with an investment of US$3.84 billion (Rp59.4 trillion). The project is expected to be completed by 2025 and will be managed by the joint venture PT Kolaka Nickel Indonesia (KNI).

PT Vale Indonesia will initially own 18.3 percent of PT KNI. Huaqi, a business unit of Zhejiang Huayou Cobalt in Singapore, will hold 73.2 percent and Ford Motor will control 8.5 percent. Under the cooperation, PT Vale Indonesia and Ford Motor have the option to increase their stakes to 30 percent and 17 percent, respectively.

The plan is for PT Vale Indonesia to mine nickel ore from the Pomalaa block and supply it to the HPAL technology hydrometallurgical plant built by Huaqi. The plant will produce 120,000 tonnes of nickel per year in the form of mixed hydroxide precipitate – the raw material for electric vehicle batteries. A total of 84,000 tonnes will be supplied to Ford Motor.

The integrated nickel mining and processing projects in Morowali and Pomalaa have been included in the list of National Strategic Projects (PSN) since July 2022

In addition, PT Vale Indonesia is partnering with Zhejiang Huayou Cobalt to develop the Sorowako Block Mine and build another HPAL nickel smelter in Malili, East Luwu, South Sulawesi.

Zhejiang Huayou Cobalt has established a local company, PT Huali Nickel Indonesia, to participate in the project, which will cost US$2 billion (Rp30.9 trillion). The smelter is expected to be operational by 2026, with a production capacity of 60,000 tonnes of nickel and 5,000 tonnes of cobalt per year in mixed hydroxide precipitate.

PT Vale Indonesia’s two joint projects with Zhejiang Huayou Cobalt have further strengthened Huayou Group’s position in Indonesia’s nickel processing industry.

Zhejiang Huayou Cobalt is a core company of the Huayou Group. It invests in natural resource mining and processing projects, including nickel, cobalt, copper and lithium, to produce and sell raw materials for electric vehicle batteries, energy storage devices, electronic products and more.

For example, Zhejiang Huayou Cobalt has developed mining operations and processing facilities for cobalt and copper in the Congo, lithium in Zimbabwe and, of course, nickel in Indonesia. The products are then further processed, including into ternary cathode materials supplied to global battery companies such as Contemporary Amperex Technology (CATL) and LG Energy Solution, and lithium-ion battery materials used by smartphone manufacturers such as Samsung, Apple and Huawei.

Huayou now indirectly controls 7.55 percent of PT Merdeka Battery Materials, the majority shareholder of PT Sulawesi Cahaya Mineral, which holds a 21,100ha nickel mining concession in Konawe, South East Sulawesi.

PT Merdeka Battery Materials is a subsidiary of PT Merdeka Copper Gold, a local mining company co-owned by a number of conglomerates including Garibaldi “Boy” Thohir, Edwin Soeryadjaya, Sandiaga Uno and Winato Kartono. CATL is also listed as holding a 5 percent stake in PT Merdeka Copper Gold through Hong Kong Brunp and CATL.

Huayou also indirectly controls 24 percent of PT Indonesia Weda Bay Industrial Park (IWIP), the manager of the Weda Bay Industrial Park in Central Halmahera, North Maluku, with an area of approximately 5,000 ha from 2022. Tsingshan Holding Group, a Chinese stainless steel producer, indirectly controls 46 percent of PT IWIP.

Huayou’s 24 percent-owned subsidiary, Veinstone Investment, controls 90 percent of PT Weda Bay Energi, which operates a 250-megawatt steam power plant in the PT IWIP area. Meanwhile, 10 percent of PT Weda Bay Energi is held by PT Daya Listrindo Utama, part of the Aserra Group, which is controlled by a trio of businessmen, Zainal Abidinsyah Siregar, Irawan Sastrotanojo and Erwin Sutanto.

Huayou is also developing two nickel processing plants in the PT IWIP industrial estate through two joint ventures: PT Huafei Nickel Cobalt and PT Huake Nickel Indonesia.

By the end of 2023, Huayou has indirect control of 53 percent of PT Huafei, which is building a HPAL smelter with a production capacity of 120,000 tonnes of nickel and 15,000 tonnes of cobalt per year in mixed hydroxide precipitate. Tsingshan’s subsidiary owns 30 percent and the subsidiary of Eve Energy, a Chinese electric vehicle battery manufacturer, owns 17 percent of PT Huafei.

Meanwhile, Huayou and Tsingshan indirectly control 70 percent and 30 percent respectively of PT Huake, which operates the RKEF smelter in the PT IWIP area with a production capacity of 45,000 tonnes of nickel in matte per year. The smelter has been in operation since 2022.

Since 2013, Tsingshan has also been working with the Bintangdelapan Group to develop the Morowali Industrial Estate in Central Sulawesi, covering an area of approximately 4,000 hectares by 2022. This land is managed by PT Indonesia Morowali Industrial Park (IMIP).

In the PT IMIP area, Huayou has another smelter, which is claimed to be the largest HPAL project in the world. This smelter is operated by a joint venture company, PT Huayue Nickel Cobalt.

As of 2023, Huayou indirectly controls 57 percent of PT Huayue, Tsingshan controls 10 percent and CMOC Group, a Chinese tungsten and molybdenum metal producer, controls 30 percent. For the record, Tsingshan plans to sell its 10 percent stake in PT Huayue to Nickel Industries, an Australian mining company.

In addition, Huayou is preparing to build the Pomalaa Industrial Estate in Kolaka, Southeast Sulawesi, with a planned land area of up to 11,808 ha. This area, which will be managed by PT Indonesia Pomalaa Industry Park (IPIP), is on the National Strategic Projects (PSN) list from December 2022.

In 2023, PT IPIP is still struggling with land acquisition issues as the industrial park area overlaps with forest land, communal land, other companies’ business licenses and state assets.

However, given the area’s status as a PSN, the government is providing full support for its development and aims to have the industrial park operational by the first quarter of 2024.

In addition, the area is expected to attract an initial investment of US$10 billion (Rp154.3 trillion) from its tenants, who plan to build the RKEF and HPAL nickel smelters, solar, hydro and gas power plants, battery recycling facilities and more.

The HPAL smelter will be managed by PT KNI and is part of the aforementioned PT Vale Indonesia, Zhejiang Huayou Cobalt and Ford Motor project. For this reason, Huayou’s cooperation with PT Vale Indonesia is important as it can guarantee the supply of nickel ore from its mines in the Pomalaa block.

In addition, Huayou claims to have other supplies from 29 concessions in Malili, South Sulawesi, and 14 concessions on Kabaena Island, Southeast Sulawesi.

As of 2023, Huayou controls 70 percent of PT IPIP through its subsidiary Huaxing Nickel. The remaining 30 percent will be controlled by PT Rimau New World, a joint venture between PT New World Nickel and PT Rimau Multi Investama.

A Chinese investor named Huang Yeping controls PT New World Nickel. He also owns several other companies in Indonesia, including PT Wan Xiang New World Resources and PT Wan Xiang New World Nickel, which transport and sell minerals and coal.

Meanwhile, PT Rimau Multi Investama is part of the Rimau Group, which is owned by businessman Antonio Yatmiko. The subsidiaries of the Rimau Group are involved in the mining, transport and sale of coal, with a concession area of at least 6,000 ha on the island of Kalimantan.

***

2. PT Aneka Tambang

CnC Nickel Concession:81,424.5 ha

Operating area: South East Sulawesi, North Maluku and West Papua

Nickel resources: 1.31 billion tonnes

Nickel ore production: 8.62 million tonnes (2022)

PT Aneka Tambang (Antam) is the Indonesian government’s main nickel producer, controlled by Mind ID. It and its subsidiaries hold 11 nickel mining concessions covering 81,424.5 hectares in four different districts: Kolaka and North Konawe (South East Sulawesi), East Halmahera (North Maluku) and Raja Ampat (West Papua). They control 1.31 billion tonnes of nickel resources, with total reserves of 462 million tonnes.

The predecessor of this company was the General Governing Agency of Indonesian State Mining Companies (BPU Pertambun). It was established in 1961 to manage all state mining companies and projects outside the coal, oil and gas, and tin sectors. These include PN Tambang Bauksit Indonesia, PN Tambang Emas Cikotok, PN Logam Mulia, PT Nikkel Indonesia and a number of other projects.

In 1968, the government merged BPU Pertambun and its various mining companies and projects into a new entity called Aneka Tambang, which was a Perusahaan Negara (PN), or State-Owned Company. Then it became a Perseroan Terbatas (PT), or limited liability company, in late 1974.

In the nickel business, Aneka Tambang is continuing a number of projects inherited from PT Nikkel Indonesia. One of these is the project on Maniang Island, Kolaka, which was taken over from PT Pertambangan Toraja. The latter had illegally exported nickel to Japan in 1956-1960, initially using ore stockpiles left over from the Japanese occupation, before mining on its own since 1959. Shipments to Japan resumed under the banner of PT Nikkel Indonesia.

In 1961, Sulawesi Nickel Development Corp, also known as Sunideco, proposed to mine nickel in Sulawesi. Sunideco was an amalgamation of five Japanese companies: Sumitomo Metal Mining, Nippon Mining, Nippon Yakin Kogyo, Shimura Kako and Pacific Metals. The Indonesian government rejected this. Negotiations were then held to allow Indonesia to mine on its own, with technical assistance from Sunideco, in return for nickel ore supplies from Sulawesi.

Represented by BPU Pertambun, Indonesia then signed an agreement with Sunideco in late 1962. Sunideco was prepared to lend US$1.35 million for the development of a nickel mine at in Pomalaa on an 8,700-hectare concession. It came with a condition that PT Nikkel Indonesia would produce 120,000 tonnes of nickel ore per year for seven years, 40 percent of which would be handed over to Japan to repay the investment debt plus interest. The remaining 60 percent would be sold commercially. It was the first production-sharing cooperation between Indonesia and a foreign party in the metallic minerals sector.

In late 1962, PT Nikkel Indonesia also began mining nickel on Lemo Island, about 12 km from Maniang Island. Mining there lasted until 1977 and is said to have produced 147,000 tonnes of nickel ore.

Within 10 years of Indonesia’s partnership with Sunideco, annual nickel ore exports from Maniang Island, Lemo Island and Pomalaa rose steadily from just 30,950 tonnes in 1963 to 838,358 tonnes in 1972.

PT Aneka Tambang has been slowly expanding its operations to include Gebe Island and Gee Island in North Maluku, and is building its own processing facilities. By 2023, the company is operating three smelters in Pomalaa and one in Tanjung Buli, East Halmahera, with a combined production capacity of up to 40,500 tonnes of nickel in ferronickel per year.

Pomalaa Past and Present (1990-2020)

In 1998, the Indonesian government began working with two foreign mining companies. The first was BHP Asia Pacific Nickel, a subsidiary of Australia’s Broken Hill Proprietary (BHP), to mine nickel on Gag Island, West Papua, through the local company PT Gag Nickel. The second is for Strand Minerals, a subsidiary of Canada’s Weda Bay Minerals, to work on nickel in Halmahera Island, North Maluku, through PT Weda Bay Nickel.

The work contracts between the government and PT Gag Nikel and PT Weda Bay Nickel were signed in 1998 for concessions of 13,136 ha and 45,065, ha respectively. This gave PT Antam a 25 percent interest in PT Gag Nickel and a 10 percent interest in PT Weda Bay Nickel without having to make a cash deposit (free-carried interests).

After 10 years of exploration and various studies, BHP decided to withdraw from the Gag Island project, which was considered less prospective. As a result, PT Antam acquired all of BHP Asia Pacific Nickel’s shares in late 2008, giving it full control of PT Gag Nickel. The company recorded nickel ore production in 2018.

Meanwhile, French mining company Eramet S.A. acquired Weda Bay Minerals in May 2006, giving it 90 percent control of PT Weda Bay Nickel through Strand Minerals. In 2017, Eramet signed a cooperation agreement with Tsingshan Holding Group, a giant Chinese stainless steel producer, for the development of PT Weda Bay Nickel’s operations. As a result, Tsingshan took 57 percent control of Strand Minerals, with Eramet holding the remainder.

After securing ore supplies from PT Weda Bay Nickel, Tsingshan and several Chinese partners built the Weda Bay Industrial Park in Central Halmahera in 2018. This area, which has been on the National Strategic Project (PSN) list since November 2020, is managed by PT Indonesia Weda Bay Industrial Park (IWIP). It covered an area of approximately 5,000 hectares in 2022.

Tsingshan now indirectly controls 46 percent of PT IWIP. Two Chinese companies, Zhenshi Holding Group and Huayou Holding Group, each own 24 percent. Chinese battery manufacturer Contemporary Amperex Technology (CATL) holds 6 percent.

Almost 22 years after the signing of the contract, PT Weda Bay Nickel finally started production in October 2019. It had produced 21 million tonnes of nickel ore by 2022, which was sold to various processing plants in the area, more specifically: 17 RKEF plants to be processed into ferronickel and one HPAL plant to produce nickel-cobalt for electric vehicle batteries.

Nickel ores were also delivered to PT Weda Bay Nickel’s own RKEF plant in the PT IWIP area, which commenced operations in 2020 and produced 37,000 tonnes of nickel in ferronickel in 2022.

Given Indonesia’s abundant nickel supply and the global trend towards the development and use of electric vehicles, the government established PT Industri Baterai Indonesia (IBC) in April 2021 to build an integrated domestic electric vehicle battery industry from upstream to downstream.

Mind ID directly controls 25 percent of IBC and another 25 percent through PT Aneka Tambang. Meanwhile, two state-owned energy companies, PT Pertamina and PT PLN, each hold 25 percent. All of these companies are under the supervision of Erick Thohir, an entrepreneur and the minister of state enterprises for 2019-2024.

Erick’s older brother, Garibaldi “Boy” Thohir, is a coal tycoon who has recently entered the nickel and aluminum processing sector, working with the raw materials for electric vehicle batteries, mainly through PT Adaro Minerals Indonesia and PT Merdeka Battery Materials.

IBC has set ambitious targets to build RKEF and HPAL technology nickel smelters and various factories by 2030, including those to produce raw materials for batteries, electric vehicle batteries and electric motorcycles and cars. It also plans to build battery exchange stations and battery recycling facilities.

To this end, Indonesia has begun to cooperate with a number of foreign partners. In mid-2021, the government and IBC signed a memorandum of understanding with battery company LG Energy Solution and South Korean carmaker Hyundai Motor Group to build a US$1.1 billion (Rp16.9 trillion) battery cell factory in Karawang, West Java.

PT Aneka Tambang has prepared its subsidiary PT Nusa Karya Arindo, which controls a 20,763 ha nickel concession in East Halmahera, to supply nickel ore for the project. The plan is for a consortium of South Korean companies to acquire 49 percent of the shares in PT Nusa Karya Arindo.

In early 2023, IBC signed another agreement with Malaysia’s Citaglobal Berhad to develop a battery cell plant and battery energy storage system (BESS). In 2022, PT Aneka Tambang also signed an agreement with China’s CNGR Advanced Materials to build a battery raw material industrial park in Pomalaa.

PT Aneka Tambang’s subsidiary, PT Kawasan Industri Antam Timur, will manage the site. CNGR Advanced Materials, through its subsidiary PT Pomalaa New Energy Materials, will build a nickel matte plant with a production capacity of 80,000 tonnes per year, which is expected to start operating in 2025.

CNGR Advanced Materials has been investing in Indonesia since 2021. It started with the construction of a 60,000 tonnes per year nickel matte plant in Morowali Industrial Estate, Central Sulawesi. Covering an area of 4,000 hectares from 2022, the site has been developed by Tsingshan together with the Bintangdelapan Group, affiliated with retired Lieutenant General Sintong Panjaitan, through PT Indonesia Morowali Industrial Park (IMIP).

In 2022, CNGR Advanced Materials will also enter the PT IWIP industrial estate. It plans to set up a new nickel matte plant with a production capacity of 120,000 tonnes per year.

In the same year, the company, together with Taiwan’s Walsin Lihwa Corp. and businessman Andi Syamsuddin Arsyad’s (Haji Isam) Jhonlin Group, began building another smelter in the Setangga Special Economic Zone in Tanah Bumbu, South Kalimantan, through PT Anugerah Barokah Cakrawala. In its initial phase, the smelter is expected to produce 40,000 tonnes of nickel matte per year.

Meanwhile, back to PT Aneka Tambang, the state-owned company has signed an agreement with IBC and Ningbo Contemporary Brunp Lygend (CBL) in 2022 to develop a domestic electric vehicle battery industry. From there, PT Antam agreed to sell a 49 percent stake in its subsidiary PT Sumberdaya Arindo to Hong Kong CBL, a subsidiary of Ningbo CBL. PT Sumberdaya Arindo holds a 14,421ha nickel mining concession in East Halmahera.

Ningbo CBL is controlled by three entities: Ningbo Brunp Contemporary Amperex, Ningbo Meishan Free Trade Port Ruiting Investment and Ningbo Lygend New Energy.

Ningbo Brunp Contemporary Amperex is a subsidiary of Contemporary Amperex Technology (CATL), the world’s largest Chinese supplier of electric vehicle batteries. Ningbo Meishan Free Trade Port Ruiting Investment, owned by Hong Kong conglomerate Robin Zeng Yuqun, is the controlling shareholder of CATL. Ningbo Lygend New Energy is a subsidiary of Lygend Resources & Technology, a Chinese nickel trading company indirectly controlled by CATL.

CATL also holds a 5 percent stake in PT Merdeka Copper Gold through Hong Kong Brunp and CATL. PT Merdeka Battery Materials, a subsidiary of PT Merdeka Copper Gold, controls PT Sulawesi Cahaya Mineral, which holds a 21,100 ha nickel mining concession in Konawe, South East Sulawesi.

In addition, China’s Zhejiang Huayou Cobalt, a producer of raw materials for electric vehicle batteries, owns 7.55 percent of PT Merdeka Battery Materials through its subsidiary Huayong International.

PT Merdeka Copper Gold is a local mining company jointly owned by a number of conglomerates, including Garibaldi “Boy” Thohir, Edwin Soeryadjaya, Sandiaga Uno and Winato Kartono.

Since 2018, Lygend Resources & Technology has been working with the Harita Group to build HPAL and RKEF nickel smelters on Obi Island in South Halmahera, North Maluku.

The Harita Group, controlled by the family of the conglomerate Lim Hariyanto Wijaya Sarwono, has a wide range of businesses in nickel, bauxite and coal mining, palm oil plantations, shipping and more. It should be noted that Lim Shu Hua (Cheryl), the granddaughter of Lim Hariyanto, also indirectly owns 16.94 percent of Lygend Resources & Technology.

According to the results of the Panama Papers investigation published by the International Consortium of Investigative Journalists (ICIJ) in 2016, Lim Hariyanto’s family owns several companies registered in Seychelles, a tax haven in the Indian Ocean. His son, Lim Gunawan Hariyanto, and two of Lim Gunawan’s grandchildren, Cheryl and Lim Chuan Loong (Brian), are listed as shareholders in Wealth Harvest Family. Cheryl also holds shares in two other companies: Tryllion and Sage Corp.

As of 2023, the Harita Group holds five nickel mining concessions covering 11,498.23 ha on Obi Island through PT Trimegah Bangun Persada Group and two other concessions covering 1,808.9 ha in the Konawe and Konawe Islands regencies through PT Gema Kreasi Perdana. Total nickel ore reserves and resources in the PT Trimegah Bangun Persada area alone are estimated at 302 million tonnes.

HPAL’s smelter on Obi Island is being constructed in three phases. The first and second phases were carried out by PT Halmahera Persada Lygend (HPL), which is 45.1 percent controlled by PT Trimegah Bangun Persada and the remainder by Lygend Resources & Technology.

In these two phases, PT HPL has built three nickel-cobalt compound production lines with a total capacity of 55,000 tonnes per year. Therefore, PT Trimegah Bangun Persada has agreed to supply a minimum of 8 million tonnes of nickel ore per year to PT HPL until December 2030.

In addition, PT HPL’s plant has the capacity to produce 240,000 tonnes of nickel sulfate per year, which will be used to produce precursors for electric vehicle batteries. The first export of PT HPL’s nickel sulfate to China took place in June 2023.

The third phase of development is currently underway by PT Obi Nickel Cobalt (ONC), which plans to add three new production lines to produce 65,000 tonnes of nickel-cobalt compounds per year. Full operations are expected to commence in the first quarter of 2024.

Lygend Resources & Technology indirectly controls 60 percent of PT ONC. Cheryl, the granddaughter of Lim Hariyanto, controls the remaining 30 percent through Li Yuen, a Singapore-based company. The remaining 10 percent is held by PT Trimegah Bangun Persada.

The RKEF smelter on Obi Island will be built in two phases, each to be carried out by joint ventures PT Halmahera Jaya Feronikel (HJF) and PT Karunia Permai Sentosa (KPS). By 2025, there will be a total of 20 ferronickel production lines with a capacity of 280,000 tonnes per year.

Lygend Resources & Technology controls 36.9 percent of PT HJF and 65 percent of PT KPS, with the remainder controlled by PT Trimegah Bangun Persada.

The cooperation between Lygend Resources & Technology and the Harita Group is part of a long-term plan to build the Obi Island Industrial Estate with an area of approximately 15,000 hectares and an investment value of Rp31.3 trillion. This area, which has been on the PSN list since November 2020, is managed by PT Dharma Cipta Mulia (DCM). As of 2023, PT DCM is still preparing a master plan and feasibility study report for this project.

Lygend Resources & Technology indirectly controls 60 percent of the shares of PT DCM, while the rest is held by PT Trimegah Bangun Persada.

***

3. PT Weda Bay Nickel

CnC Nickel Concession:45,065 ha

Operating area:North Maluku

Nickel resources: 634.9 million tonnes

Nickel ore production: 21.1 million tonnes (2022)

PT Weda Bay Nickel is a joint venture between state-owned PT Aneka Tambang and Strand Minerals, which hold 10 percent and 90 percent, respectively. Strand Minerals was originally owned by Canada’s Weda Bay Minerals, which has been exploring on the island of Halmahera, North Maluku, since 1996.

PT Weda Bay Nickel signed a contract with the Indonesian Government on 19 January 1998 and was granted a 30-year license to mine nickel on 120,500 hectares of land in Central Halmahera and East Halmahera.

Negotiations with the government resulted in the company’s concession being reduced to 45,065 ha with an estimated nickel ore resource of 634.9 million tonnes as of January 2019.

Four months after the contract was signed in 1998, the authoritarian President Suharto resigned under pressure from a movement demanding democratic reform. His successor, B.J. Habibie, served as president until he was succeeded by Abdurrahman Wahid, familiarly known as Gus Dur, in October 1999. About a month before his resignation, Habibie issued Forestry Law No. 41/1999, which caused headaches for PT Weda Bay Nickel and other mining companies.

The law prohibits open-pit mining in protected forest areas. PT Weda Bay Nickel’s concession includes 35,155 hectares of the Ake Kobe Protected Forest. As a result, the company halted its exploration activities in 2001.

PT Weda Bay Nickel, together with 11 other companies, including PT Freeport Indonesia, PT Vale Indonesia and PT Aneka Tambang, negotiated with the government for an exemption on the grounds that their licences were issued before the 1999 Forestry Law. Their efforts were successful. The government amended the law in 2004, allowing them to resume operations.

In May 2006, French mining company Eramet S.A. acquired Weda Bay Minerals, giving it 90 percent control of PT Weda Bay Nickel through Strand Minerals. Attracted by Halmahera’s vast nickel potential, Mitsubishi Corp. bought a 33.4 percent stake in Strand Minerals.

Four months later, the government approved PT Weda Bay Nickel’s Environmental Impact Assessment (AMDAL), despite allegations that the process was flawed.

For example, during the public consultation phase, representatives of the Sawai indigenous community living in the company’s concession area were given hundreds of pages of documents to study just before the meeting. As a result, the local indigenous community did not fully understand the contents of the document, and did not even know that mining activities would displace plantation land.

Once the AMDAL was finalized, a lengthy negotiation process began to acquire customary land in PT Weda Bay Nickel’s concession area. The company’s offer of Rp 7,000-8,000 per square meter was initially rejected. However, following cases of social conflict and criminalization, the company slowly succeeded in taking over the land and livelihoods of the local community.

The economic crisis in Europe and the oversupply of nickel caused international nickel prices to plummet and many mining companies, including Eramet, made huge losses in 2013. This led Eramet, Mitsubishi and Pacific Metals (which bought a 3.4 percent stake in Strand Minerals from Mitsubishi in 2011) to suspend their investment in the Halmahera project.

Another important factor was Indonesia’s plan to ban nickel ore exports from early 2014, a policy designed to encourage the development of a domestic mining processing industry.

The uncertain situation ultimately led Mitsubishi and Pacific Metals to withdraw from the Halmahera mine project. They sold their entire 33.4 percent stake in Strand Minerals back to Eramet in April 2016.

The following year brought a ray of hope for Eramet. On 11 January 2017, Indonesia relaxed its export ban and allowed certain commodities to be sold abroad, including nickel ore with a grade of less than 1.7 percent. One of the conditions was that the company had to build a new smelter in Indonesia within five years.

In 2017, Eramet signed a cooperation agreement with Tsingshan Holding Group, a giant Chinese stainless steel producer, to revive PT Weda Bay Nickel. Tsingshan officially took 57 percent control of Strand Minerals, with Eramet holding the remainder.

After securing ore supplies from PT Weda Bay Nickel, Tsingshan, together with several Chinese partners, then built the Weda Bay Industrial Estate in Central Halmahera in 2018.

This area, which has been on the National Strategic Project (PSN) list since November 2020, is managed by PT Indonesia Weda Bay Industrial Park (IWIP). It is expected to attract investments worth US$15 billion (Rp232.9 trillion) by 2024 and will cover an area of around 5,000 hectares by 2022.

Weda Bay Past and Present (2000 vs 2020)

From 2023, Tsingshan will control 46 percent of PT IWIP through its subsidiary Perlux Technology. Two Chinese companies, Zhenshi Holding Group and Huayou Holding Group, control 24 percent each of PT IWIP through their Hong Kong subsidiaries Cornerstone Investment and Huachuang International Investment. There is also Contemporary Amperex Technology (CATL), a Chinese battery manufacturer, which controls 6 percent of PT IWIP through its Hong Kong subsidiaries Brunp and CATL.

According to a study by the Association for Ecological Action and People’s Emancipation, published in July 2023, PT IWIP’s nickel mining and industrial estate development has caused various social, environmental and health problems, particularly in four villages in Central Halmahera: Lelilef Sawai, Lelilef Woebulen, Gemaf and Sagea.

Despite this, Tsingshan and Eramet appear to be aggressively pushing forward with the development of the Halmahera project.

Eramet is targeting PT Weda Bay Nickel to increase nickel ore production to 30 million tonnes in 2023. PT IWIP is also reported to be expanding its industrial estate to 15,000ha.

In 2022, Eramet established a local legal entity, PT Eramet Indonesia Mining, and began exploration for new mining sites in Indonesia. Together with German chemical giant BASF, Eramet plans to build a new HPAL plant in Halmahera at an estimated cost of US$2.6 billion (Rp40.4 trillion) to produce nickel-cobalt for electric vehicle batteries.

In 2023, Eramet merged with the Kalla Group, owned by businessman and former vice president Jusuf Kalla, to form PT Eramet Bumi Sulawesi. According to data from the Ministry of Law and Human Rights, this company is involved in nickel ore mining, with 70 percent of the shares controlled by PT Eramet Indonesia Mining and 30 percent by PT Bumi Mining Lestari, part of the Kalla Group.

In July 2023, the Kalla Group signed an agreement with Eramet, battery company PowerCo S.E., which is owned by Germany’s Volkswagen Group, and Dutch automotive company Stellantis N.V. to build a green electric vehicle (RGEV) center in Indonesia.

Tsingshan has also been working with the Bintangdelapan Group, owned by businessman Halim Mina, since 2013 to develop the Morowali Industrial Estate in Central Sulawesi, which is managed by PT Indonesia Morowali Industrial Park (IMIP). The area is claimed to have attracted up to US$20.93 billion (IDR 324.4 trillion) in investment in 2022, covering an area of 4,000 hectares.

Retired Lieutenant General Sintong Panjaitan is the chairman of a number of key companies in the Bintangdelapan Group. He is also the commissioner of PT Adimitra Baratama Nusantara, a coal mining company in East Kalimantan controlled by PT TBS Energi Utama, which is owned by the Coordinating Minister for Maritime Affairs and Investment, Luhut Binsar Pandjaitan. PT TBS Energi Utama recently collaborated with PT GoTo (Gojek-Tokopedia) through the joint venture PT Energi Kreasi Bersama (Electrum) to build a domestic electric motorcycle factory in Cikarang, West Java.

Zhejiang Huayou Cobalt, Huayou’s subsidiary that controls 24 percent of PT IWIP, is also working with PT Vale Indonesia to develop two new HPAL smelters in Kolaka (Southeast Sulawesi) and East Luwu (South Sulawesi).

Huayou is also working with Tsingshan to build a RKEF and HPAL plant in the PT IWIP area and a HPAL plant in the PT IMIP area.

In addition, Huayou is preparing to build the Pomalaa Industrial Park in Kolaka with a planned land area of up to 11,808 ha. This area, which will be managed by PT Indonesia Pomalaa Industry Park (IPIP), has been on the PSN list since December 2022 and is expected to attract an initial investment of US$10 billion (Rp154.3 trillion).

Huayou controls 70 percent of PT IPIP through its subsidiary Huaxing Nickel. The remaining 30 percent is controlled by PT Rimau New World, a joint venture jointly controlled by Chinese investor Huang Yeping and businessman Antonio Yatmiko’s Rimau Group, whose subsidiaries are involved in coal mining, with a concession area of at least 6,000 ha on the island of Kalimantan.

Huayou also indirectly controls 7.55 percent of PT Merdeka Battery Materials, the majority shareholder of PT Sulawesi Cahaya Mineral, which holds a 21,100 ha nickel mining concession in Konawe, South East Sulawesi.

PT Merdeka Battery Materials is a subsidiary of PT Merdeka Copper Gold, a local mining company co-owned by a number of conglomerates including Garibaldi “Boy” Thohir, Edwin Soeryadjaya, Sandiaga Uno and Winato Kartono. China’s CATL is also listed as having an indirect 5 percent stake in PT Merdeka Copper Gold.

On the other hand, Zhenshi, which controls 24 percent of PT IWIP, controls 70 percent of PT Fajar Bhakti Lintas Nusantara, a nickel mining company on Gebe Island, Central Halmahera. Thirty percent of PT Fajar Bhakti is controlled by PT Halmahera Sentra Mineral, an iron sand mining company in North Halmahera which is owned by the family of business couple Agung Dewa Chandra and Maria Chandra Pical. The family also controls PT Gebe Sentra Nikel, another nickel mining company on Gebe Island.

The couple’s business appears to be in trouble. PT Halmahera Sentra Mineral’s permit to mine iron sand had been granted CnC status, meaning there was no violation of mining regulations, but it was revoked by the government in 2011.

The Investment Coordinating Board also revoked the mining licenses of PT Gebe Sentra Nikel in April 2022 and PT Fajar Bhakti in September 2023. Moreover, Maria is said to have given Rp250 million in gratuities to former Ambon mayor Richard Louhenapessy between 2011 and 2022.

Another company, PT Daya Listrindo Utama, is listed as a shareholder in two companies linked to PT IWIP. It controls 51 percent of PT Weda Bay Port, which manages port services, and 10 percent of PT Weda Bay Energi, which manages a 250-megawatt steam electric power station at the PT IWIP industrial estate.

PT Daya Listrindo Utama is part of the Aserra Group, which is controlled by a trio of businessmen: Zainal Abidinsyah Siregar, Irawan Sastrotanojo and Erwin Sutanto. Aserra Group’s subsidiaries are involved in oil and gas exploration and production, coal and nickel mining, oil palm plantations, property leasing, electric vehicle production and other businesses.

One of Aserra Group’s subsidiaries is PT Citra Lampia Mandiri, a nickel mining company with a concession area of 2,660 hectares in East Luwu regency in South Sulawesi province. More than half of the company – 59.5 percent, specifically – is held by Junaidi, a close friend of, and lawyer for, Andi Syamsuddin Arsyad or Haji Isam. The latter is a South Kalimantan businessman and owner of the Jhonlin Group, which has business interests in coal mining, oil palm and rubber plantations, aviation and other sectors.

Haji Isam indirectly controls the majority of shares in PT Citra Lampia Mandiri after reportedly helping to mediate and secure the victory of Zainal in a company ownership dispute against a rival, Helmut Hermawan. During the complicated dispute, Helmut allegedly bribed former deputy minister of law and human rights Edward Omar Sharif Hiariej with a total of Rp8 billion to protect his interests.

Another subsidiary of the Aserra Group, PT Nusajaya Persadatama Mandiri, holds a license to mine nickel on 1,825 hectares in Morowali. There is also PT Alessa Motors Nusantara, which produces batteries and electric motorbikes.

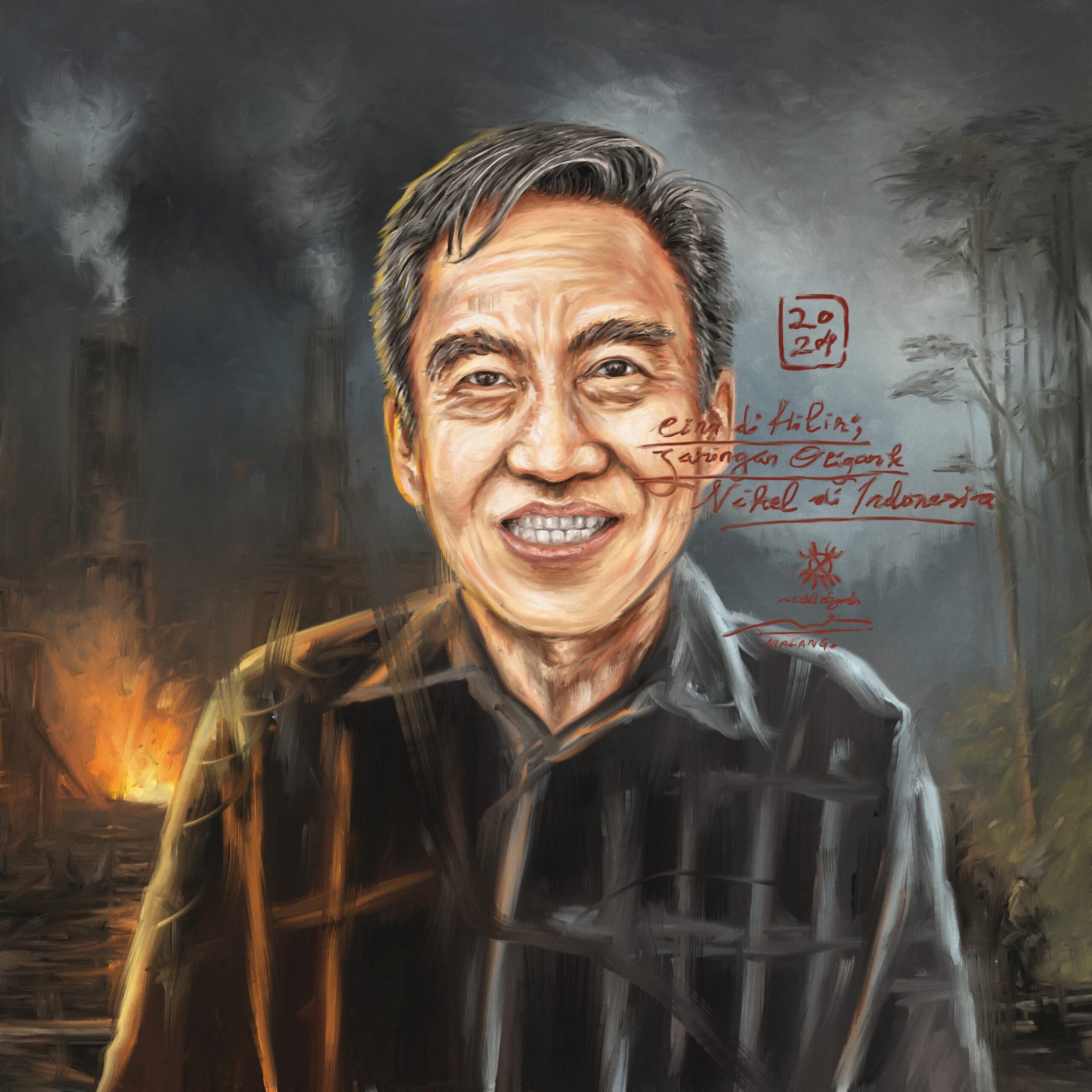

4. Bintangdelapan Group

CnC nickel concessions: 27,144 ha

Non-CnC Nickel Concessions:25,262

Operating area:Central Sulawesi

Nickel resources:N/A

Nickel Ore Production: 4.5 million tonnes (2016)

For the government of President Joko Widodo, Bintangdelapan Group is an important part of a success story in attracting Chinese investment to Indonesia, particularly in the nickel mining and processing sector.

By the end of 2023, Bintangdelapan Group’s subsidiaries control at least six nickel mining concessions covering a total area of 52,406 hectares in Morowali, Central Sulawesi.

The group’s main mining company is PT Bintangdelapan Mineral, with a concession area of 20,765 ha. There is also 6,379 ha of land controlled by three different companies: PT Kencana Nusantara Sakti, PT Kencana Bumi Mineral and PT Nusa Mineral Semesta.

PT Bintangdelapan Energi also holds a nickel mining concession covering 4,902 ha., although this concession expired on 18 February 2022. It was one of 2,078 mining licenses (IUP) covering a total area of 3.2 million ha that the Investment Coordinating Board (BKPM) planned to revoke in the period January-April of that year.

One of the reasons for the revocation is that many IUP holders don’t actually plan to carry out mining on the land for which they hold a licence. Some companies simply use the IUPs as collateral for bank transactions.

PT Bintangdelapan Energi sued BKPM at the Jakarta State Administrative Court (PTUN) in June 2022 and won in November. As a result, the BKPM had to reinstate the company’s IUP. The BKPM filed an appeal and cassation in 2023, but to no avail.

Nevertheless, as of January 2024, the company’s license was not included in the list of official IUPs considered to be in compliance with government requirements (with CnC status).

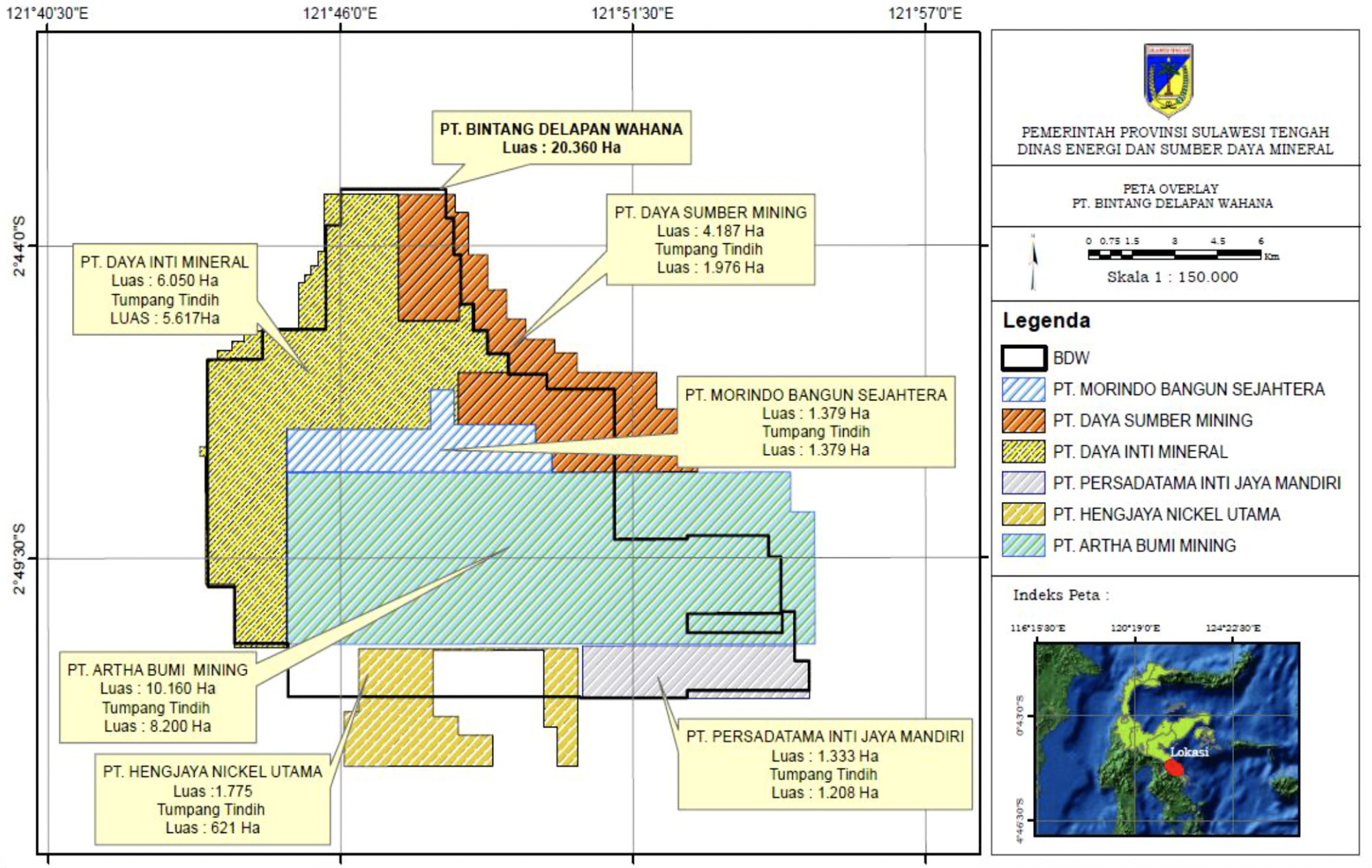

PT Bintangdelapan Wahana also holds a 20,360-ha land concession, also in Morowali. However, it overlaps with the operations of several other miners, which has resulted in legal challenges and an inability to secure a CnC licence for the land.

At the helm of the Bintangdelapan Group is businessman Halim Mina, who directly and indirectly controls the majority of shares in the group’s nickel mines and part of the shares in the joint venture company PT Indonesia Morowali Industrial Park (IMIP), which manages the Morowali Industrial Park, covering an area of 4,000 hectares by 2022.

Meanwhile, retired Lieutenant General Sintong Panjaitan has been appointed as the chief executive officer of a number of key companies: PT Bintang Delapan Capital, PT Bintang Delapan Investama, PT Bintangdelapan Energi, PT Bintangdelapan Wahana and PT Bintangdelapan Mineral.

Sintong is also a commissioner of PT Adimitra Baratama Nusantara, a coal mining company in East Kalimantan. The company is controlled by PT TBS Energi Utama, which is owned by Coordinating Minister for Maritime Affairs and Investment, Luhut Binsar Pandjaitan. PT TBS Energi Utama recently collaborated with PT GoTo (Gojek-Tokopedia) through a joint venture, PT Energi Kreasi Bersama (Electrum), to build a domestic electric motorcycle factory in Cikarang, West Java.

Halim originally founded the Bintangdelapan Group in 1994 as a fertilizer trading company. Despite the Asian economic crisis of the late 1990s, his business continued to grow and in 2001 he acquired most of the shares of PT Dover Chemical, a petrochemical company where he had previously worked.

Halim tried his luck in mining after his company was awarded an exploration license in Konawe, Southeast Sulawesi, in 2003. Four years later, six companies in the Bintangdelapan Group, including PT Bintangdelapan Mineral and PT Bintangdelapan Energi, secured concessions totalling 20,397 hectares from the then regent of Konawe. At the time, the regent was empowered to grant licenses under the Regional Government Act 2004.

In January 2010, the six different licenses were merged into one under the banner of PT Bintangdelapan Wahana.

Seven months later, the government changed the boundaries of Central Sulawesi and Southeast Sulawesi so that PT Bintangdelapan Wahana’s area of operation included Morowali, Central Sulawesi. The authority to issue IUPs thus shifted from the Konawe Regent to the Morowali Regent, who then revised the company’s concession area to 20,360 ha in July 2014.

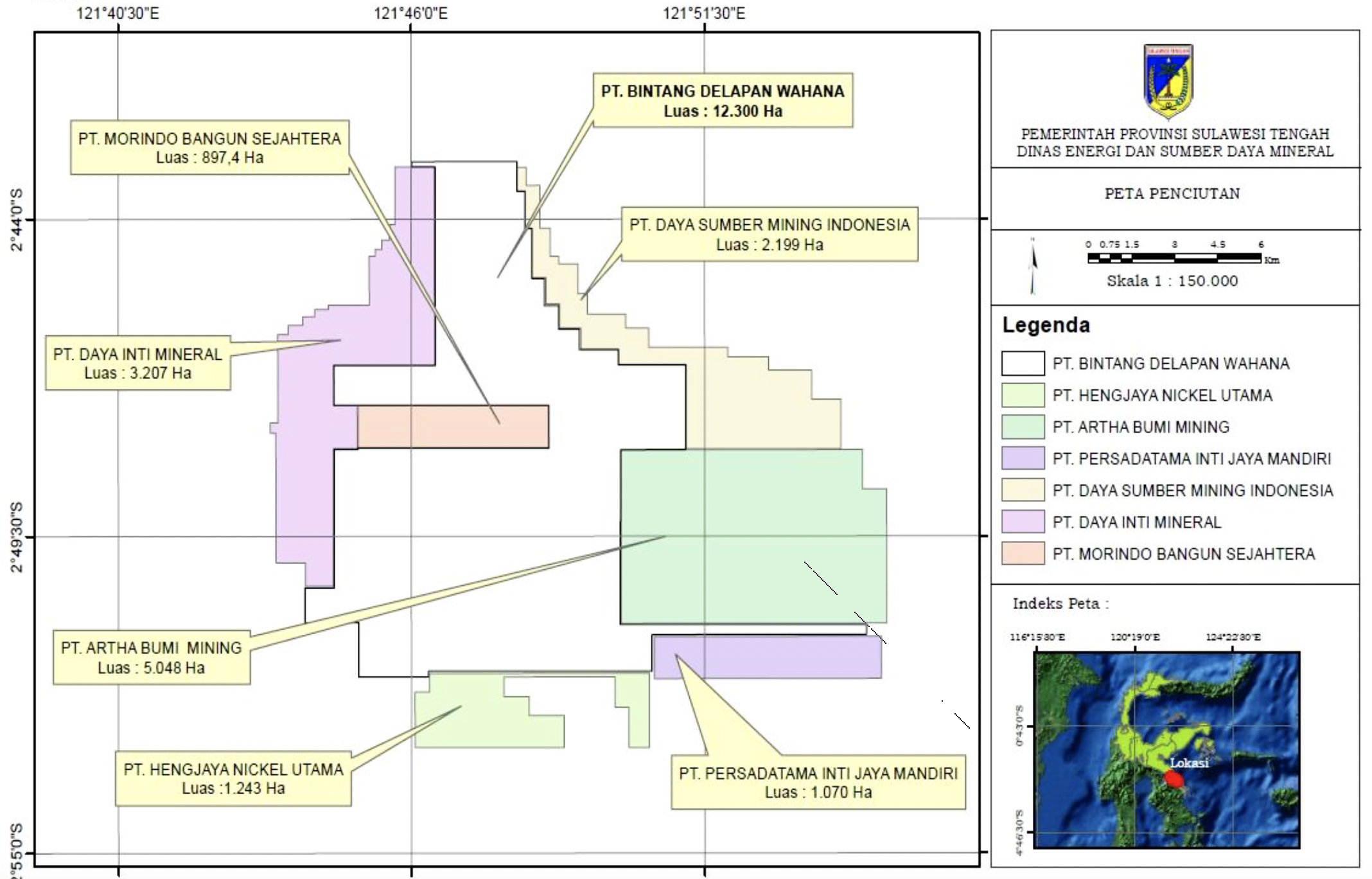

The company soon realized that its concession area overlapped with the operational areas of PT Persadatama Inti Jaya Mandiri, PT Daya Inti Mineral, PT Artha Bumi Mining, PT Daya Sumber Mining Indonesia, PT Morindo Bangun Sejahtera and PT Hengjaya Nickel Utama. The problem was that PT Bintangdelapan Wahana’s license was issued by the Konawe Regent in 2007, while the mining licenses of the other six companies were issued by the Morowali Regent in 2008-2009.

As a result, the Morowali Regent revoked PT Bintangdelapan Wahana’s IUP in November 2014. However, since October of the same year, the authority to determine IUPs had shifted back from the regent to the governor due to the enactment of a new Regional Government Law. The governor of Central Sulawesi then overturned the Morowali regent’s decision in December 2015. PT Bintangdelapan Wahana breathed a sigh of relief, but only temporarily.

To resolve the issue of overlapping concessions, the governor of Central Sulawesi reduced the size of each company’s operating area in May 2016. As a result, PT Bintangdelapan Wahana’s area was reduced to 12,300 hectares. This prompted the companies to sue the governor in court, while also attacking each other.

The concession disputes dragged on. PT Bintangdelapan Wahana sued the governor of Central Sulawesi and related companies (except PT Hengjaya Nickel Utama) at the Palu Administrative Court in August 2016. It requested the cancellation of the concession-area reduction and the reissuance of the IUP for the 20,360 ha of land. After a year, PT Bintangdelapan Wahana’s appeal was granted.

In July 2017, the governor and five other companies appealed to the Makassar Administrative Court, which again ruled in favor of PT Bintangdelapan Wahana. An appeal to the Supreme Court was rejected in March 2018, but a judicial review was granted in November 2021.

As a result, PT Bintangdelapan Wahana’s first appeal was dismissed. However, it filed a second review in January 2023 and won again four months later.

While the case was pending, the Bintangdelapan Group continued to expand its operations in Morowali.

In 2010, PT Bintangdelapan Mineral began producing and exporting nickel ore to Tsingshan Holding Group, a giant Chinese stainless steel producer. Following the enactment of the 2009 Mineral and Coal Mining Law, which banned the export of raw minerals (including nickel ore) from early 2014, the Bintangdelapan Group sensed a new opportunity. It invited Tsingshan to work with it to set up a processing plant in Morowali.

The government welcomed the plan. Bintangdelapan Group and Tsingshan then officially signed a cooperation agreement to build the Morowali Industrial Estate on 3 October 2013 during a visit to Indonesia by Chinese President Xi Jinping.

After 10 years, they claim to have attracted investments of up to US$20.93 billion (Rp324.4 trillion).

There are 52 tenants who have built factories in the industrial complex. They are grouped in three industrial clusters. The first is a stainless steel cluster with a production capacity of 4 million tonnes per year, with additional production of 3 million tonnes of hot rolled coils (HRC) and 1.1 million tonnes of cold rolled coils (CRC).

Second, a carbon steel cluster with a capacity of 4.8 million tonnes per year. Thirdly, the cluster for electric vehicle battery components, which produces 120,000 tonnes of nickel-cobalt and 120,000 tonnes of nickel sulphide per year.

One of its tenants is PT Indonesia Tsingshan Stainless Steel (ITSS), whose smelter furnace exploded on 24 December 2023, killing at least 21 workers and injuring 38. This was just one of more than 20 industrial accidents that occurred in the Morowali Industrial Estate during the year.

Tsingshan owns 51 percent of PT ITSS directly and 29 percent indirectly through its two business units, Ruipu Technology Group and Tsingtuo Group. The remaining 20 percent is split equally between PT IMIP and the Japanese trading company Hanwa.

Meanwhile, Tsingshan indirectly controls 66.25 percent of PT IMIP, which manages the Morowali Industrial Estate. The remaining 33.75 percent is directly or indirectly controlled by PT Bintang Delapan Investama.

Morowali Past and Present (2000 vs 2020)

After a successful partnership with the Bintangdelapan Group, Tsingshan continues to expand in Indonesia.

In 2017, two years after the inauguration of the first smelter in the PT IMIP area, Tsingshan signed a cooperation agreement with the French mining company Eramet S.A. to develop the operations of PT Weda Bay Nickel. The latter controls a 45,065ha concession in Central Halmahera and East Halmahera, North Maluku, with nickel ore resources of 634.9 million tonnes.

Tsingshan also acquired 57 percent stake of Strand Minerals, which owns 90 percent of PT Weda Bay Nickel. Together with several Chinese partners, Tsingshan then established the Weda Bay Industrial Park in Central Halmahera in 2018. The site is managed by PT Indonesia Weda Bay Industrial Park (IWIP). It is expected to attract investments worth US$15 billion (Rp232.9 trillion) by 2024 and will cover an area of around 5,000 hectares by 2022.

As of 2023, Tsingshan controls 46 percent of PT IWIP through its subsidiary Perlux Technology. Two Chinese companies, Zhenshi Holding Group and Huayou Holding Group, each indirectly control 24 percent of PT IWIP. The remaining 6 percent is held by Contemporary Amperex Technology (CATL), a Chinese battery manufacturer.

Tsingshan and Huayou are also involved in investing in several nickel processing facilities. They are building two smelters in the PT IWIP area, using both HPAL and RKEF technologies, respectively, through joint ventures PT Huafei Nickel Cobalt and PT Huake Nickel Indonesia.

In the PT IMIP area, Huayou has another smelter which is claimed to be the largest HPAL project in the world. This smelter is operated by the joint venture PT Huayue Nickel Cobalt. As of 2023, Huayou indirectly controls 57 percent of PT Huayue, Tsingshan controls 10 percent and CMOC Group, a Chinese tungsten and molybdenum metal producer, controls 30 percent.

Tsingshan plans to sell its 10 percent stake in PT Huayue to Nickel Industries, an Australian mining company. Nickel Industries controls 80 percent of PT Hengjaya Mineralindo, which holds a 5,983ha nickel mining concession in Morowali.

The remaining 20 percent is owned by the family of businessman Adi Wijoyo, who also has interests in nickel mining companies PT Erabaru Timur Lestari and PT Genba Multi Mineral. The two companies hold concessions totalling 4,903 hectares in Morowali and North Morowali.

As of 2022, Nickel Industries owns three RKEF smelters in the PT IMIP area and one in the PT IWIP area. Part of the saprolite nickel ore requirement for the RKEF plant in the PT IMIP area will be sourced from PT Hengjaya Mineralindo. The latter also supplies limonite nickel ore for PT Huayue’s HPAL smelter.

In 2022, Nickel Industries also secured an agreement to sell limonite nickel ore produced by PT Hengjaya Mineralindo to PT QMB New Energy Materials, which operates the HPAL smelter in Morowali Industrial Estate. PT QMB New Energy Materials is a joint venture company jointly owned by PT IMIP, Tsingshan, CATL, Chinese battery recycler GEM, South Korean battery raw material producer EcoPro and Japan’s Hanwa.

Tsingshan, Huayou, CATL and GEM are also affiliated with PT Merdeka Copper Gold, a local mining company jointly owned by a number of conglomerates, including Garibaldi “Boy” Thohir, Edwin Soeryadjaya, Sandiaga Uno and Winato Kartono.

CATL owns 5 percent of PT Merdeka Copper Gold, which controls 50.03 percent of PT Merdeka Battery Materials. The latter is also controlled by Huayou with an indirect interest of 7.55 percent.

PT Merdeka Battery Materials acquired 51 percent of PT Sulawesi Cahaya Mineral from J&P Group in March 2002. Tsingshan also indirectly controls 49 percent of PT Sulawesi Cahaya Mineral, which holds a 21,100ha concession in Konawe with nickel resources of 1.14 billion tonnes.

In addition, PT Merdeka Battery Materials and Tsingshan have a number of joint ventures that operate three RKEF smelters for the production of low-grade ferronickel (NPI) and a plant for the production of high-grade nickel matte at the Morowali Industrial Estate.

It has also signed agreements with CATL and GEM to build two new HPAL smelters by 2023, and is building another plant with Tsingshan to produce iron pellets, copper, gold and silver, as well as sulphuric acid and steam.

In addition, Tsingshan and PT Merdeka Battery Materials intend to replicate the success of PT IMIP and PT IWIP by building a new 3,854.37ha industrial park in Konawe through a joint venture company, PT Indonesia Konawe Industrial Park (IKIP).

According to the plan, the IKIP area will be the center of the HPAL smelter, whose nickel ore will be supplied by PT Sulawesi Cahaya Mineral. It should be noted that this project is different from the Konawe Industrial Estate, which is managed by PT Virtue Dragon Nickel Industrial Park.

Editor: Fahri Salam

Translation: Tito Ambyo

English-Language Editor: Ary Hermawan

English Copy Editor: Zacharias Szumer

Support Project Multatuli

Support Project Multatuli